Real clients, real refunds: CSULB accounting students provide free help to local taxpayers

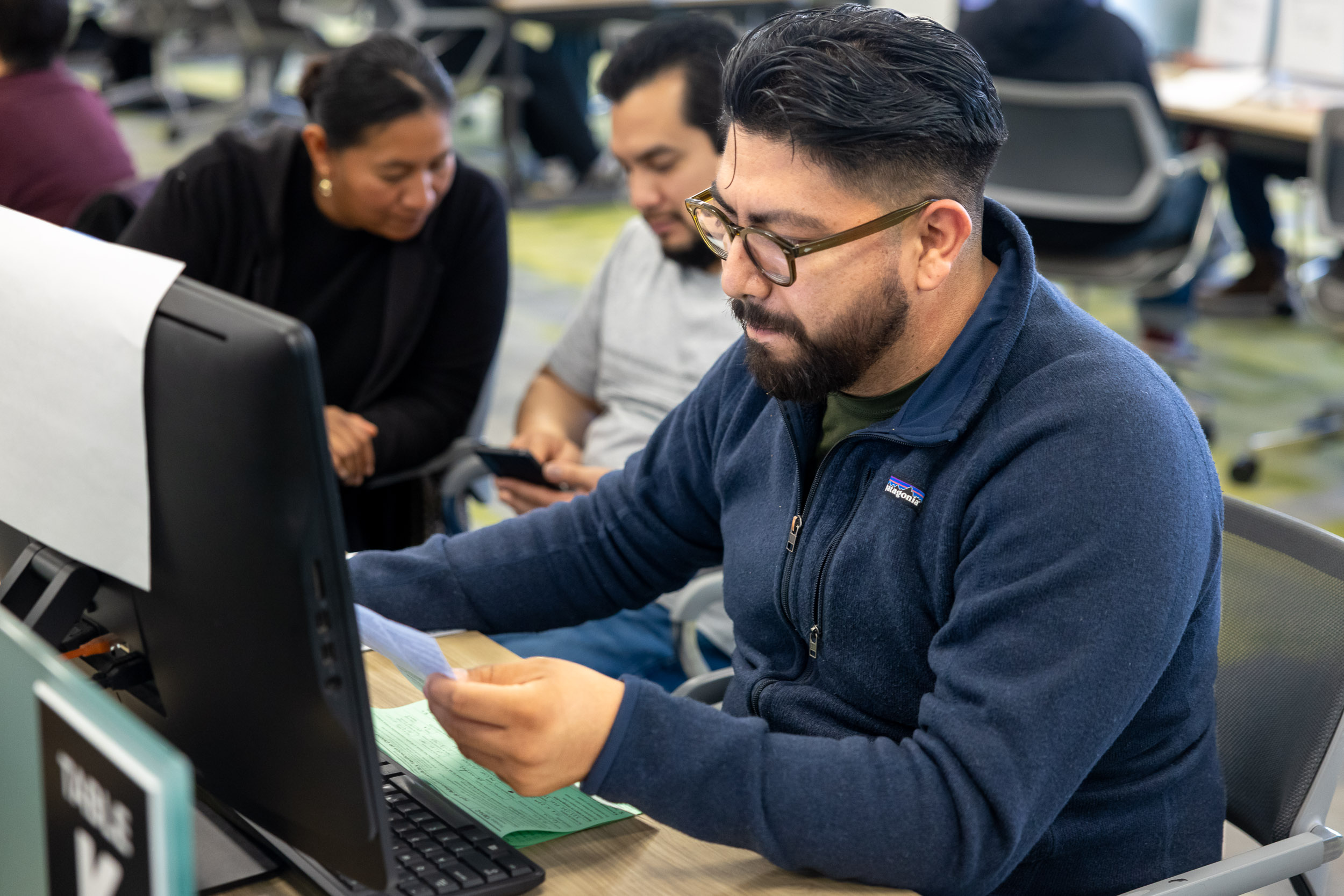

Shoaeb Sheik, an international student studying information systems at Cal State Long Beach, stared at the W-2 forms in his hands, utterly lost.

“I don’t know anything about tax filing,” he admitted.

Like any student facing a problem, he turned to Google.

“I searched ‘CSULB taxes,’ and VITA was the first thing that came up,” he said.

That shouldn’t come as a surprise. Since the 1970s, the Volunteer Income Tax Assistance (VITA) program at CSULB has offered free tax preparation services to students, low-income families and senior citizens — all while giving accounting students immersive training and industry exposure.

When Sheik arrived at VITA on the second floor of the College of Business recently, he found a handful of student volunteers ready to help. As a first-year graduate student from India with two campus jobs, he expected the process to be complicated. Instead, within an hour or so, his return was complete, and he left with both a clearer understanding of the tax system and a modest refund.

For Sheik, it was a relief. For the students assisting him, it was a taste of professional life.

Unlike other VITA programs, CSULB is an official course — ACCT 352 — allowing students to earn academic credit while gaining practical skills in tax preparation and client service. The course also counts toward CPA exam education requirements.

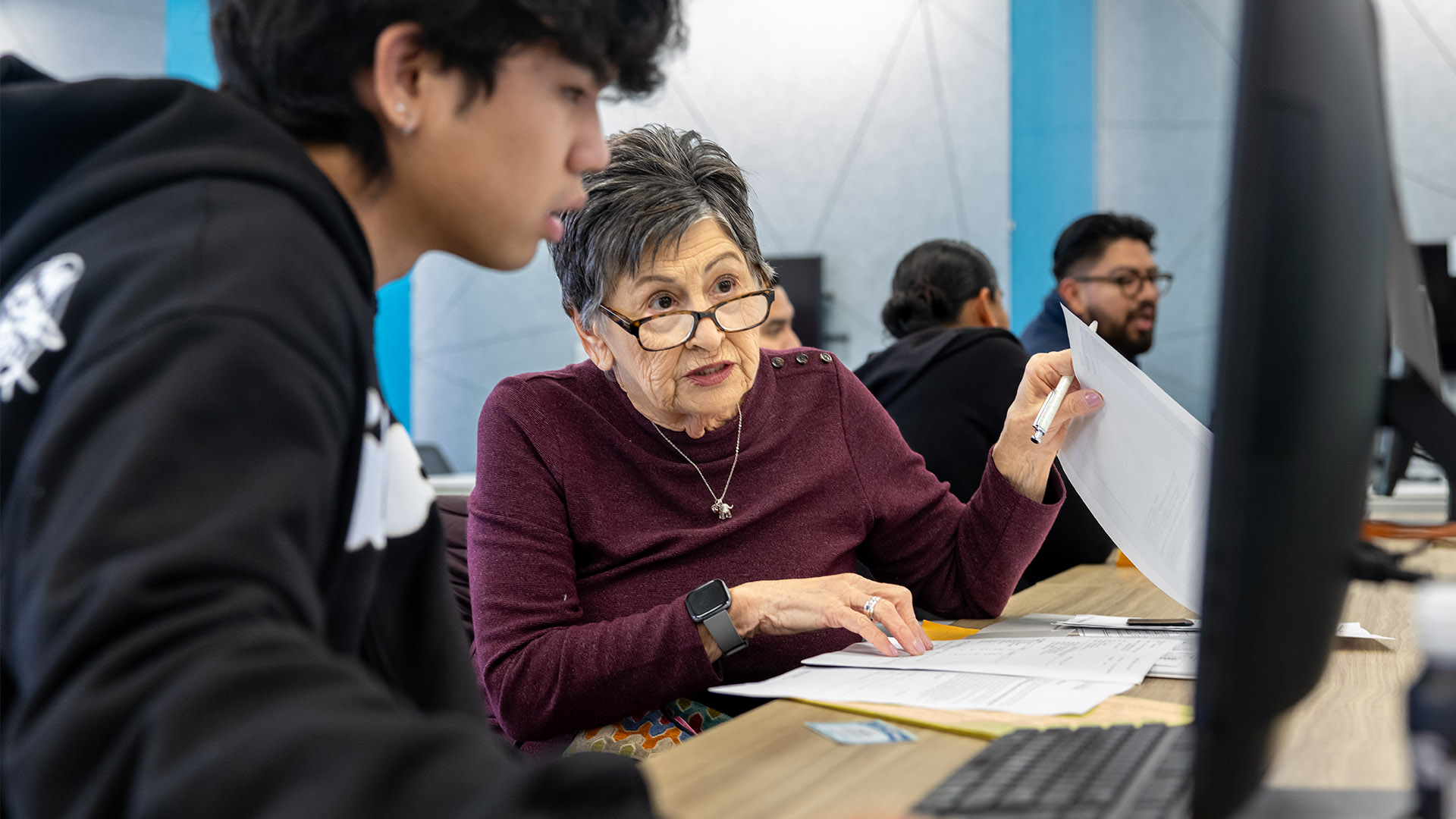

Beyond technical skills, students develop professional and interpersonal abilities, especially when handling sensitive financial situations.

“Most of our volunteers file their own taxes, so that’s really good,” said Anne Camille Reyes Guzman, the Spring 2025 VITA site coordinator. “Aside from that, though, they learn how to talk to people. It really boosts their networking skills.”

Many students find that their time with VITA shapes their career decisions. Guzman, who started as a VITA volunteer before becoming a site coordinator, credits the program with helping her discover her passion for tax accounting.

“When I was a sophomore, I wasn’t sure what I wanted to do,” she said. “Then I did VITA, and that just sealed the deal.”

That doesn’t happen for everyone, though.

“Students who volunteer for VITA either figure out they love taxes, or they hate it,” said Sudha Krishnan, chair of CSULB’s Accountancy Department and director of VITA. “There’s no in-between.”

"Last year, VITA helped nearly 1,600 people and secured $1.27 million in refunds for clients," Krishnan said, adding that the service is especially crucial for students, immigrants and families who may struggle with complex tax forms or language barriers.

Last year, VITA helped nearly 1,600 people and secured $1.27 million in refunds for clients.

An IRS initiative with partnerships across the country, VITA at CSULB operates five days a week with extended hours in March and April. At peak times, there can be a three- to four-hour wait, with volunteers preparing more than 50 returns a day. Some clients come in groups, with students bringing in friends or families filing together.

Even with training, some cases present unexpected challenges. One year, a client arrived claiming to be unhoused — despite reporting an income of $87,000. “We had to send him to the IRS site,” Krishnan said.

Others arrive frustrated or confused.

“What people got mad about post-COVID is, ‘Why is my refund so low?’” Krishnan said. Students had to explain that during the pandemic, the government gave out extra relief money. That’s not happening anymore.

Students also learn how to deliver bad news, whether it’s a lower refund than expected or a tax bill.

“You’re trained,” Krishnan said. “But at the same time, you’re not ready.”

Not, that is, until you're sitting next to real clients.

VITA at CSULB continues to evolve, offering expanded training, virtual meetings and bilingual volunteers — in Hindi, Spanish, Khmer and Tagalog — as well as a Discord channel for instant communication.

As tax season intensifies, Guzman and her team prepare for their busiest days.

“The guy who waits for Tax Day to file...” she said, laughing. There are plenty of them.

While VITA receives state and federal grants, Krishnan has become adept at securing external funding from accounting firms to fill some gaps. “Local firms have stepped up, but additional support is always needed.”

Much of that support, Krishnan said, comes from firms that go on to hire CSULB accounting students straight out of VITA.

In that way, VITA has become more than a service; it’s become a cornerstone of the community — providing on-the-job training for students, a talent pipeline for firms and, most importantly, vital support for underserved members of the community.