Verification

Verification

Verification is when the Department of Education or the California Student Aid Commission (CSAC) selects your financial aid application for additional review. In general, our office will need to confirm the people in your household and who is attending college, and your family's income information. We might also need to confirm your high school completion and your identity. Review the information below for help on completing this process.

Your FAFSA or CA Dream Act Application may have been selected for review, or verification. If so, you might need to provide our office with additional information or documentation to complete your financial aid file.

Your FAFSA or Dream Act Application may have been selected for review, or verification. If so, you might need to provide our office with additional information or documentation to complete your financial aid file.

With our new eForm process, all of the financial aid forms that you might need to submit are available as webforms, to be completed online. This significantly reduces pages to print and having to submit in-person; by fax; or by mail.

Signature Pages

However, for forms that require a parent or spouse signature, you or your parent/spouse will need to print a signature page. We understand that you might want to maintain strict social distancing and also not be able to print at home.

If both are true, please contact our office at (562) 985-5471 to speak with a financial aid staff member. We will be able to print the signature page for you and mail it to you for a signature.

Paper Forms

We have moved to an eForm process that allows you to submit all of your CSULB forms and additional materials online. However, we know that there are some families that may not want to engage in the eForm process and use the webforms.

If you require any paper copies of the forms, please contact our office at (562) 985-5471 to speak with a financial aid staff member. We will be able to print the necessary forms for you and mail them to you for completion.

Your family size is a factor in calculating your Expected Family Contribution. When selected for Verification, we will generally need to confirm who lives in your household. We do this by asking you to complete a Household Verification form.

The financial aid application has very specific guidelines on who they consider as part of your household. For Dependent Students, the following people should be counted and reported on your Household Verification form:

| Yourself | Make sure to include yourself, even if you don't live in your parents' house |

|---|---|

| Your Parents | Include all parents listed on the FAFSA. This might include step-parents and adoptive parents. Do not include your non-custodial parent. Find out who counts as your parent on your financial aid application. |

| Your Parents' other children | Include siblings that your parents provide more than 50% financial support to during the academic year, even if they don't currently live with your parents |

| Other people | Include any other people who live in your parents' house and who receive more than 50% of their financial support from your parents |

For Independent Students, the following people should be counted and reported on your Household Verification form:

| Yourself | Make sure to include yourself |

|---|---|

| Your Spouse | Include your spouse |

| Your children | Include children that you provide more than 50% financial support to during the academic year, even if they don't live in your house |

| Other people | Include any other people who live with you and who receive more than 50% financial support from you or your spouse |

If we are asking you to complete and submit a Dependent Student Income Verification form on your To Do List in your myCSULB Student Center, you will need to let us know whether you worked; how much income you made; and whether you filed a tax return. Depending on your answers to those questions, you might need to provide additional documents along with the Income Verification form.

If you filed a federal tax return

If you filed a tax return, you will need to provide additional documentation confirming your tax return information.

If you filed a federal tax return with a Social Security Number, this will either be in the form of a signed and dated Tax Return or a Tax Return Transcript.

If you filed a federal tax return using an ITIN, you should submit a signed and dated 1040 income tax return form. Please review the sections below on these methods.

If you didn't file a tax return

If you were not required to file a tax return, whether you worked or not, you only need to submit the Dependent Student Income Verification form. Make sure that the entire form is completed. If you did work, you will need to provide a W-2 statement or 1099 statement for each source of income. If you cannot provide a W-2 or 1099 statement, please call us at 562-985-5471 to discuss your options.

If we are asking you to complete and submit a Parent Income Verification form on your student's To Do List on their myCSULB Student Center, you will need to let us know whether you worked; how much income you made; and whether you filed a tax return. Depending on your answers to those questions, you might need to provide additional documents along with the Income Verification form.

If you filed a federal tax return

If you filed a tax return, you will need to provide additional documentation confirming your tax return information.

If you filed a federal tax return with a Social Security Number, this will either be in the form of a signed and dated Tax Return or a Tax Return Transcript.

If you filed a federal tax return using an ITIN, you should submit a signed and dated 1040 income tax return form. Please review the sections below on these methods.

If you were married and filed separately, you will need to provide documentation for each taxpayer. If you were married and filed jointly and are now separated; divorced; or widowed, submit your W-2 statements for us to separate your income.

If you didn't file a tax return

If you were not required to file a tax return, whether you worked or not, you will need to submit a Verification of Non-Filing letter. You can obtain this from the IRS via their website; by phone; or by submitting Form 4506-T to the IRS. You can review further instructions below.

If you did work, you will also need to provide a W-2 statement or 1099 statement for each source of income. If you cannot provide a W-2 or 1099 statement, please call us at 562-985-5471 to discuss your options.

If we are asking you to complete and submit an Independent Student Income Verification form on your To Do List on your myCSULB Student Center, you will need to let us know whether you worked; how much income you made; and whether you filed a tax return. Depending on your answers to those questions, you will need to provide additional documents along with the Income Verification form.

If you filed a federal tax return

If you filed a tax return, you will need to provide additional documentation confirming your tax return information.

If you filed a federal tax return with a Social Security Number, this will either be in the form of a signed and dated Tax Return or a Tax Return Transcript.

If you filed a federal tax return using an ITIN, you should submit a signed and dated 1040 income tax return form. Please review the sections below on these methods.

If you were married and filed separately, you will need to provide documentation for each taxpayer. If you were married and filed jointly and are now separated; divorced; or widowed, submit your W-2 statements for us to separate your income.

If you didn't file a tax return

If you were not required to file a tax return, whether you worked or not, you will need to submit a Verification of Non-Filing letter. You can obtain this from the IRS via their website; by phone; or by submitting Form 4506-T to the IRS. You can review further instructions below.

If you did work, you will also need to provide a W-2 statement or 1099 statement for each source of income. If you cannot provide a W-2 or 1099 statement, please call us at 562-985-5471 to discuss your options.

Our preferred method for you to complete this process is for you to make an appointment with a Financial Aid and Scholarships counselor in Beach Central.

If you are unable to come to campus, please contact our office at (562) 985-5471 for alternative options.

Verifying your Income

This section will provide information and instructions on how to confirm income information for the verification process.

You may submit a Tax Return Transcript to complete the verification process. This is a document obtained from the IRS that confirms that information that you filed on your tax return.You will be submitting the Transcript to our office along with the requested Income Verification form.

To get a Tax Return Transcript from the IRS:

- Request online. Use the "Get Transcript" tool available at the IRS website

- You will need to confirm your identity with the IRS through information found on your tax return, such as your Social Security Number, name, and address.

Make sure to submit your Transcripts with any requested CSULB forms for accurate processing. Do not send any transcripts directly to the University, as we are unable to process them and they will be shredded.

If you filed a tax return, you may submit a signed, dated copy of your income tax return. This will satisfy the income verification documentation for the verification process.

Dependent Students

If you filed a tax return, submit a signed and dated copy of your tax return.

Parents

A signed and dated tax return is required for all parents listed on the FAFSA. If your parents filed separately, each parent must submit their tax return.

Independent Students

If you filed a tax return, submit a signed and dated copy of your tax return. If you are married and your spouse filed separately from you, they will also need to submit a signed and dated copy of their tax return.

If you did not file a tax return, you will need to submit a Verification of Non-Filing letter. This is a document obtained from the IRS that confirms you did not file a tax return.You will be submitting the Letter to our office along with the requested Income Verification form.

To request the IRS Verification of Non-Filing and the Wage and Income Transcript:

- Request online. Use the "Get Transcript" tool available on IRS.gov

- You will be able to obtain both the Verification of Non-Filing and a Wage and Income Transcript online

Make sure to submit your documents with any requested CSULB forms for accurate processing. Do not have the IRS send materials directly to the University, as we are unable to process them and they will be shredded.

FAQs

If you do not have any of the listed identifiers and did not file, you will not be able to obtain a Verification of Non-Filing Letter from the IRS. Instead, you should submit a signed and dated statement that states the following:

- You do not have a Social Security Number, an Individual Taxpayer Identification Number, or an Employer Identification Number; and

- Lists the sources and amounts of earnings, other income, and resources that supported the yourself for the appropriate tax year; and

- Submit W-2 or 1099 statements for each of the listed sources of income

This statement should be submitted along with the requested Income Verification form.

Note: Anyone who submits W-2 statements that total a gross income equaling or exceeding the IRS tax filing threshold must request a Social Security Number, an Individual Taxpayer Identification Number, or an Employer Identification Number and file an income tax return before you or your student is eligible to receive financial aid.

If you amended your tax return, you will need to submit alternative documentation. This is because both the IRS Data Retrieval Tool and the Tax Return Transcript only confirm the information on your originally-filed tax return; they do not confirm the information from your amended tax return. You will need to submit the following:

- A complete copy of your IRS Tax Return Transcript (see instructions below) and

- A signed copy of your Amended Tax Return (Form 1040X)

- If box 8863 or 8962 on Line 15 is checked, you must also provide the appropriate schedules with the signed 1040X.

OR

- A signed copy of your original (pre-amended) Income Tax Return (Form 1040, and Schedules 1, 2, and 3 if applicable) and

- A signed copy of your Amended Tax Return (Form 1040X)

- If box 8863 or 8962 on Line 15 is checked, you must also provide the appropriate schedules with the signed 1040X.

If you filed only a foreign tax return, you must submit a transcript obtained from the tax authority that includes all of your income and tax information required to be verified for the tax year. This transcript must be translated into English, but any amounts can be left in the original currency. If you would like to convert the currency, you should use the conversion rate as of the date of submission for your financial aid application (not the date you are completing the form).

If a free transcript is unavailable, you must provide our office with documentation that the tax authority charges a fee to obtain your tax information, along with a signed copy of your income tax return that was filed with the relevant tax authority.

If you filed both a foreign return and a US tax return, follow the instructions above on submitting a Tax Return Transcript or using the IRS Data Retrieval Tool. The FAFSA or CA Dream Act Application will use the information on your US Tax Return.

If your identity was stolen, you may not be able to obtain a Tax Return Transcript or use the IRS Data Retrieval Tool. You will need to submit a Tax Return DataBase View (TRDBV) transcript as well as a statement you have signed and dated indicating that you were victims of tax-related identity theft and that the IRS has been made aware of it.

You can find more information on reporting tax-related identity theft to the IRS on their Taxpayer Guide to Identify Theft site.

If you were married and filed jointly and are now separated; divorced; or widowed, submit your W-2 statements for us to separate your income.

If you were married at the time you submitted the FAFSA or CA Dream Act Application, but weren't married when you filed your tax return, you will need to submit income information for both you and your spouse, even though you weren't married when you filed taxes.

If your biological or adoptive parents are divorced, you would only list the information of your custodial parent on your FAFSA or CA Dream ACt Application. Your custodial parent is whichever parent provides more than 50% of your financial support, or with whom you live more than 50% of the year. Do not list any information about your non-custodial parent on your FAFSA or CA Dream Act Application.

If your custodial parent has married or re-married, you will need to include the demographic and income information for that step-parent on your FAFSA.

Requesting Verification Documents on MyCSULB

To retrieve pending Financial Aid Forms that are currently listed on your To Do list in your myCSULB Student Center, follow the instructions below. The forms you request will be emailed to your student CSULB email address. Please note that no financial aid forms will be mailed; you can only access them through your MyCSULB Student Center.

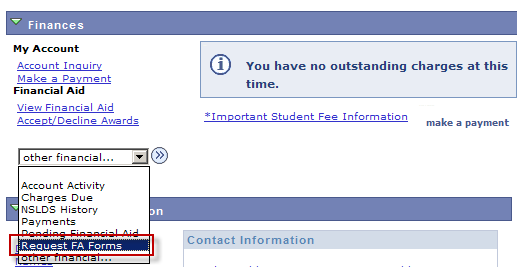

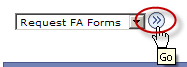

Step 1: Navigate to the Student Center and click on the drop down menu under the Finances section. Select "Request FA Forms" and click on the go arrow.

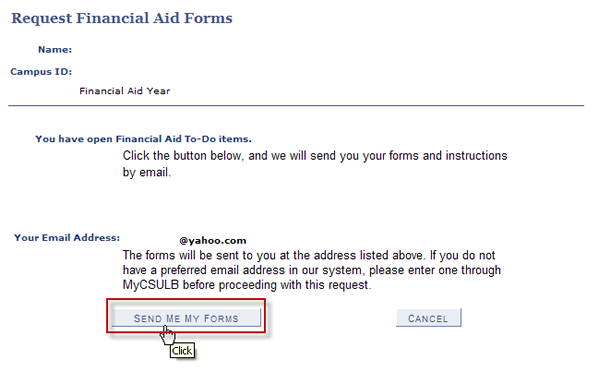

Step 2: Click on the "Send Me My Forms" button to have the forms emailed to you. The forms will be emailed as links to eForms. Once you have completed the forms, you can submit them electronically.

To retrieve pending Financial Aid Forms that are currently listed on your To Do list in your myCSULB Student Center, follow the instructions below. The forms you request will be emailed to your preferred email address. Please note that no financial aid forms will be mailed; you can only access them through MyCSULB.

Step 1: Log in to Applicant Self-Service

Step 2: Follow the prompts on each screen to check your Admissions Application Status

Step 3: After requesting an Application Status, do not exit the window

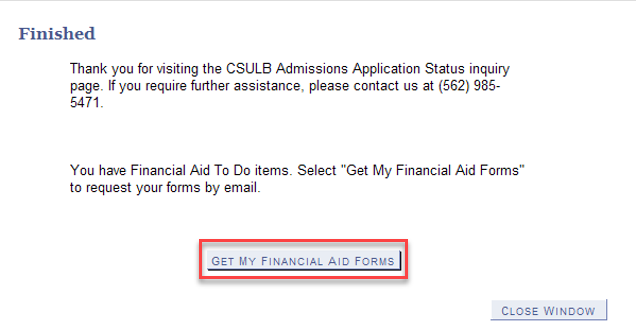

Step 4: Click the "Get My Financial Aid Forms" button at the bottom of the screen

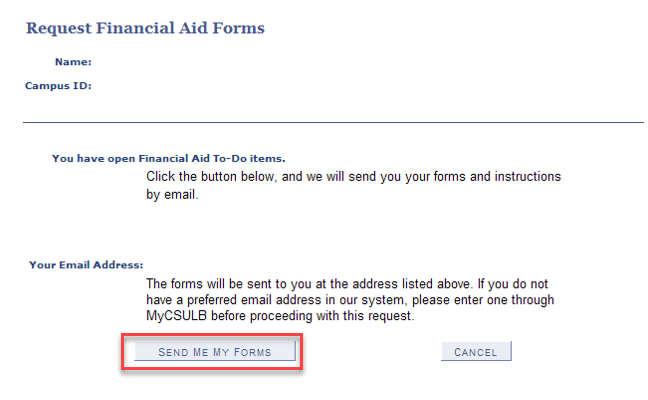

Step 5: Check to see if you have any open Financial Aid To-Do items and click on "Send Me My Forms".

Step 6: Click on the "Send Me My Forms" button to have the forms emailed to you. The forms will be emailed as links to eForms. Once you have completed the forms, you can submit them electronically.